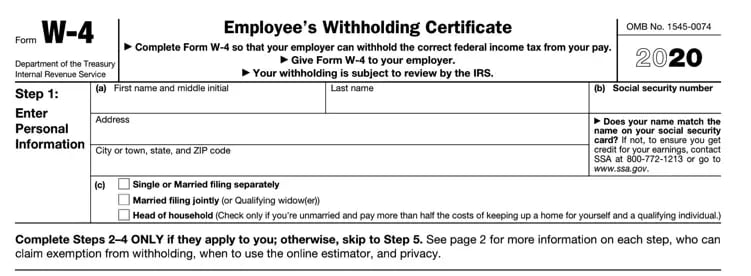

The 2018 and 2019 Forms W-4 included the first batch of changes that were brought about by the Tax Cuts Job Act (TCJA). The 2020 W-4 form completes the process so that our Employee's Withholding Certificate (W-4) is now aligned with the tax changes that were a result of the TCJA.

Here is a summary of some of the changes that you may notice:

- The word Allowance has been taken off the name of the form and we no longer choose a number of allowances.

- The available options for your anticipated filing status have changed.

- The form is a full page.

- The option to claim "Exempt" is no longer an obvious one. On page 2 of the document, you will see what someone should do if they are claiming "Exempt."

Two additional bits of information you may want to be aware of:

Two additional bits of information you may want to be aware of:- Employees are not required to complete a new 2020 W-4 form. The tables for using the 2019 form are still available to use and iSolved will still calculate taxes if nothing is changed from what an employee had listed in 2019.

- A GA Department of Revenue representative told the APA that federal form W-4 will no longer be accepted for state withholding purposes in 2020, but to check the updated state form (Form G-4) for additional information. The updated version should be available early in 2020.