Our NEW isolved release goes live September 3, 2021.

Benefit Evaluation Utility

Our 7.16 release continues to build on the latest 7.15 release as we add two more evaluations to the benefit evaluation utility that will be helpful during the client implementation process and open enrollment season:

- Employees with missing beneficiary dependent field requirements such as birthday, social or gender

- Employees who do not meet the requirements for routing and account information, such as an employee enrolled in an HSA plan that requires bank information and it is missing on the employee record.

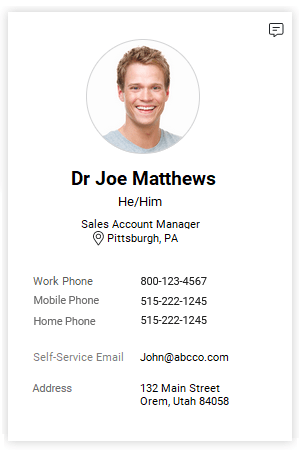

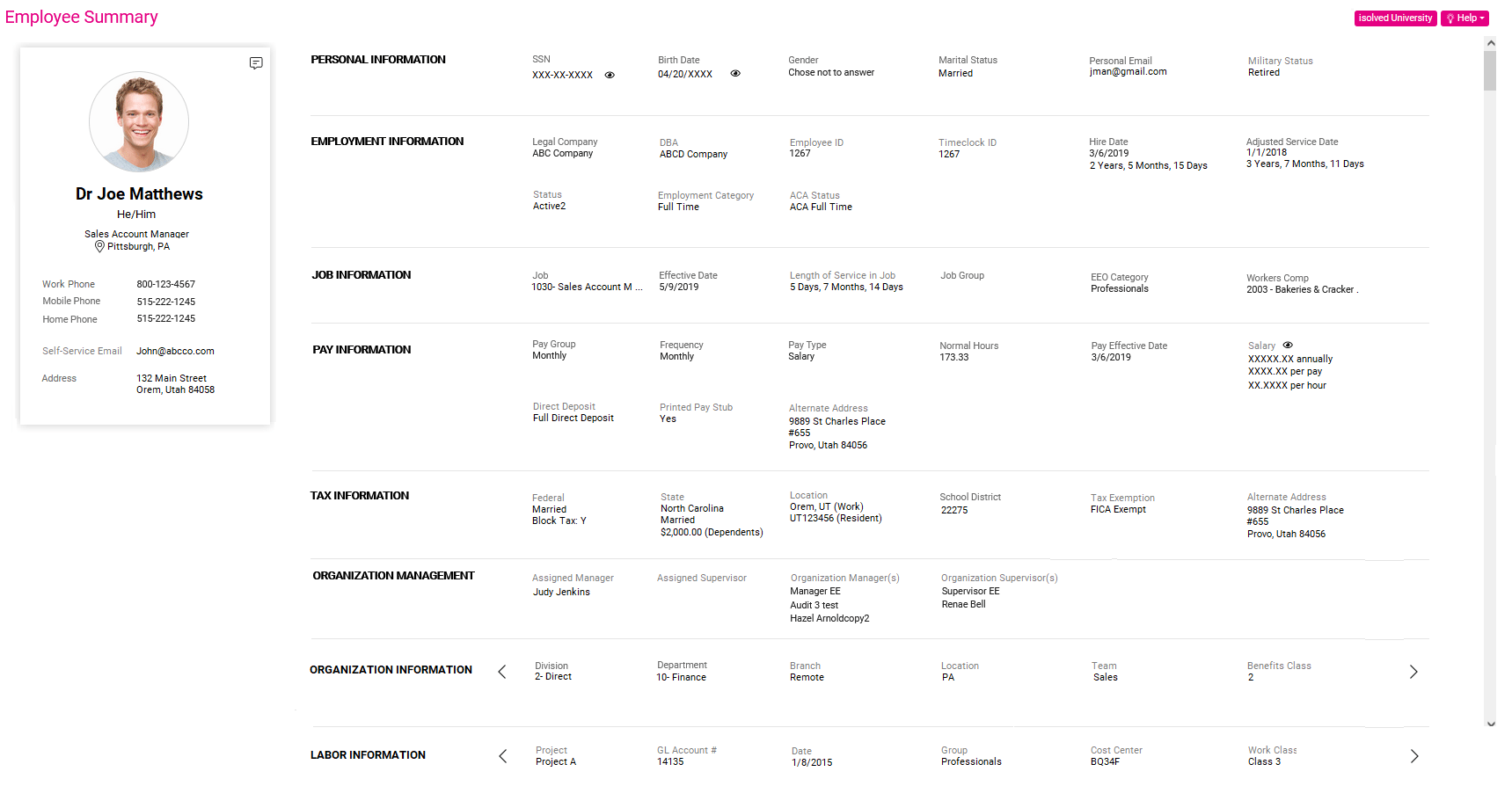

Employee Summary and Employee Profile Screen

Several enhancements have been made to both our Employee Summary and Employee Profile Screens that we believe users will find exciting and helpful. In the interest of privacy and in accordance with federal law, we are removing the EEO information from the summary. Along with this change, we have implemented some additional fields to the employee profile:

- Contact card with profile picture for the employee

- Field for preferred pronouns

- Job title and work location

- Contact phone numbers

- Self-service email address

- Home address

- Link to employee notes

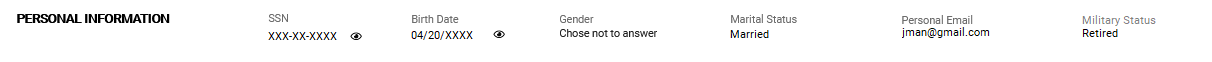

Within the Personal Information area, we are adding an icon that allows users with proper permissions to unmask the SSN and Birth Date within the summary. A field that displays an employee’s Military status has also been added on this screen.

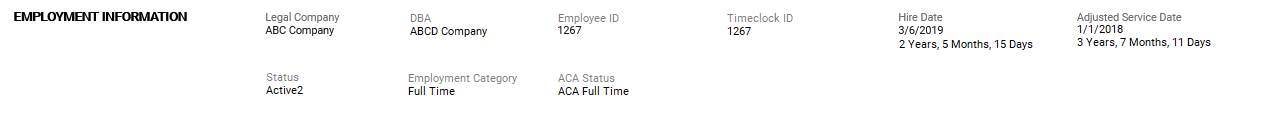

The following records have been added within the Employment Information area:

- DBA

- Timeclock ID

- Length of Service for Hire Date

- Adjust Service Date with Length of Service

- ACA Status

NOTE: For terminated employees, the employment category will no longer display, instead the termination type and reason will be displayed.

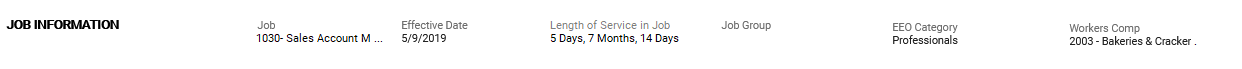

Job Information the following items were added/adjusted:

- Length of service they have been in the job title

- Job Group

- The FLSA seasonal exempt as they are used for reporting info only

- Moving the assigned manager/supervisor to

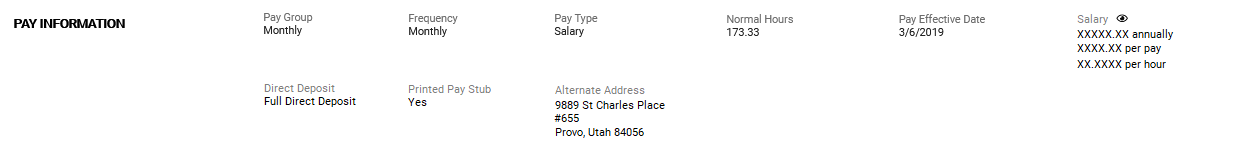

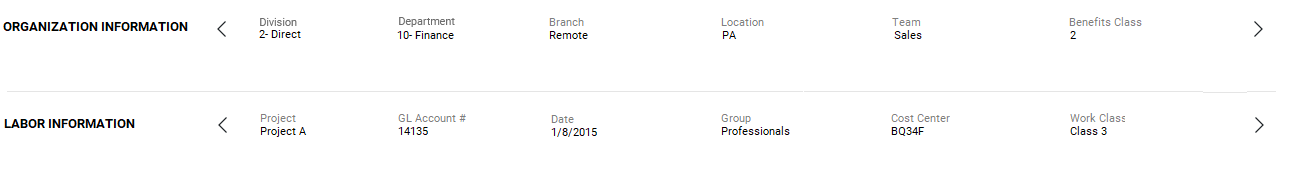

Pay Information will now only display on the EE summary and have been masked with an eye icon that can be clicked to view the salary based on salary restrictions permissions. The following fields were also added:

- Direct Deposit to see if they have a full or partial setup or none

- Whether their check stub is printed based on the employee general screen

- Alt. Address (override address) on file to send the paystubs.

Within the Tax Information section, the W4 fields for Federal and State have been updated and the work and resident locations have been combined to show on one area. The following items were added as well:

- Tax Exemption Field

- Alt. Address (override address) on file to send the tax forms.

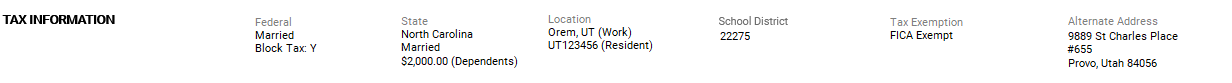

Managerial Assignments will now list both assigned and organization manager/supervisor information. If the manager or supervisor is terminated, an icon will appear as pictured below.

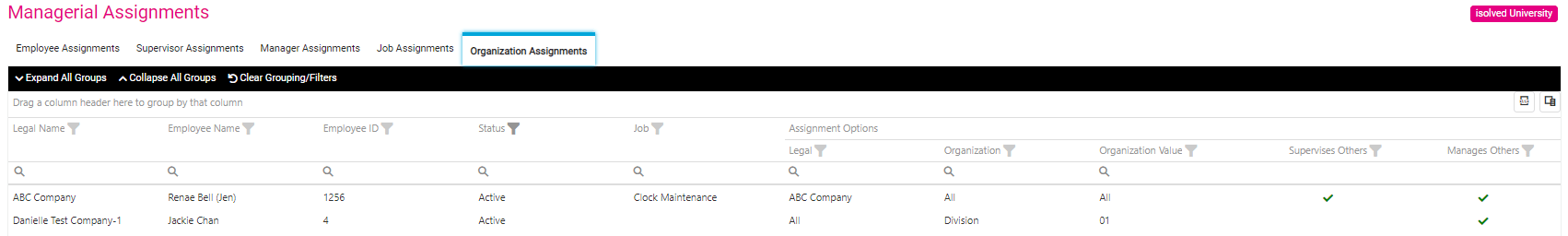

The Organization Information & Labor section has been reformatted with a carousel type design to display maximum detail in these areas.

Below is a screenshot of how the updated Employee Summary will appear:

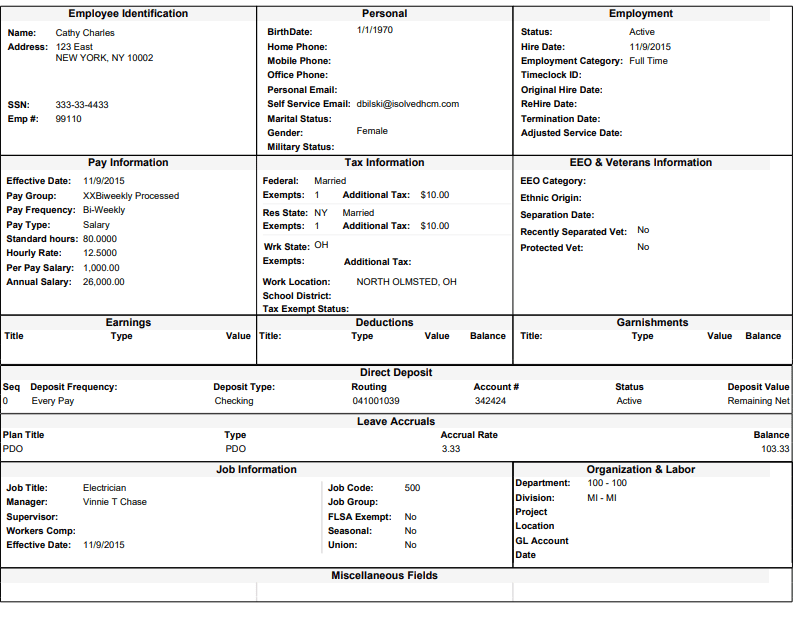

This 7.16 release has also updated all versions of the Employee Profile Report to display 2020 W4 data.

Time Attestations & Notes on Punches

Our 7.16 release continues to build on the latest 7.15 release as we add two more evaluations to the benefit evaluation utility that will be helpful during the client implementation process and open enrollment season:

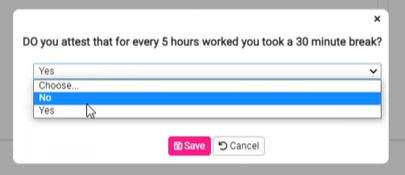

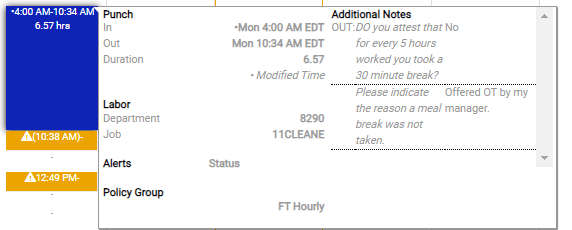

In compliance with a California Attestation requirement, the 7.16 release has added new attestation to grant users the ability to ask employees questions when they clock in and out. However, this exciting new feature can also be used for COVID-19 health checks and standard break attestation. The screen shot below shows an employee who has indicated that they did not take the required breaks for every specified, legal amount of time worked during a single shift. An employee’s answer to this attestation question can be utilized during detailed, quick, and auto punch functionality in time. Anytime an employee answers “no” to taking a break, it will be noted on the individual timecard along with any associated notes

Here is an example of the employee clocking out at the end of the day. You can see they have the option to choose Yes or No to the question asked.

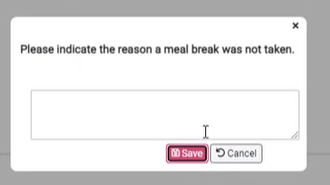

If they choose “No”, the employee will be prompted for a response on why.

Once saved, here is an example of the attestation response displayed on the timecard.

Catch up on Release 7.15 – This release showcased a streamlined methods for users to keep track of and maintain employee information.

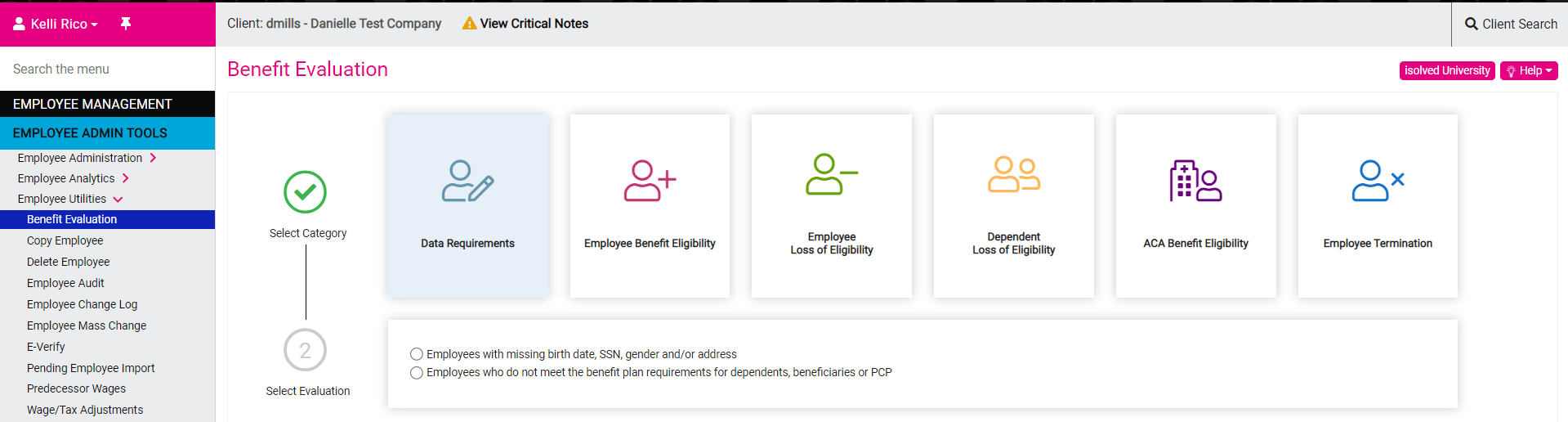

Benefit Evaluation Utility

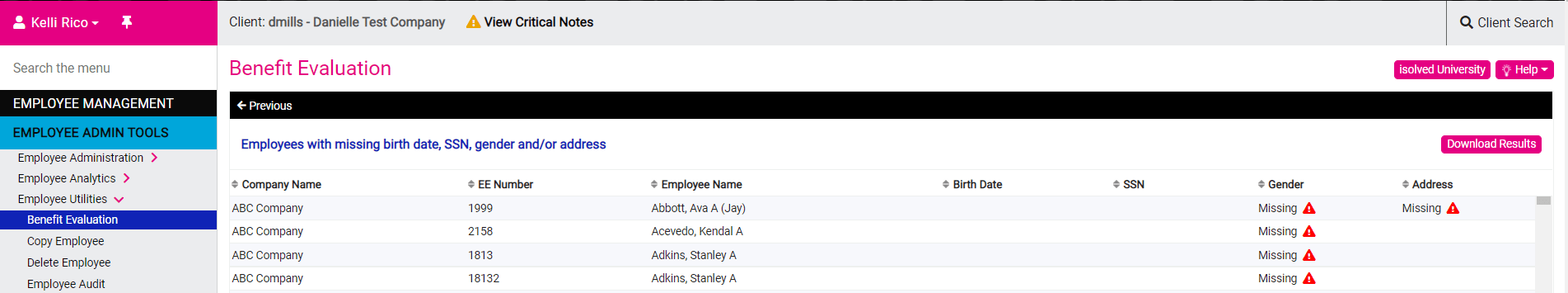

Our 7.15 release has an exciting new evaluation that helps identify employee profiles that are missing important details from our predefined categories such as birth date, social security number, gender, and address. When selecting the “Data Requirements” category on the far left of the new user interface, two radio button sub-category options will be displayed as listed below for identifying employees with missing fields.

- Show Employees with any missing values

- Show employees with missing required values only.

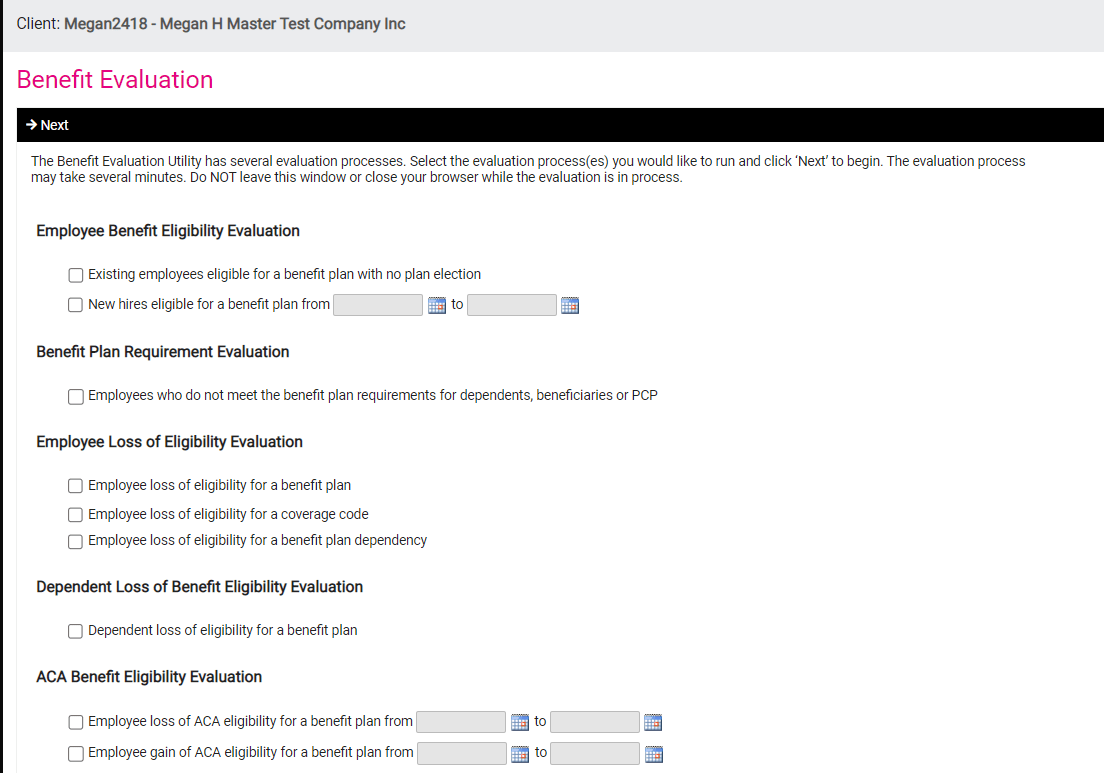

This change is key for implementation success and auditing. As you can observe in the third screen shot below, the user can successfully query employees who meet your selected radio button criteria. Finally, there’s been a streamlined update to radio buttons under the Employee Loss of Eligibility category which is third from the left. This is a notable improvement over the former check boxes in the last screen shot below.

The below image is a screenshot of how the tool appeared prior to this release.

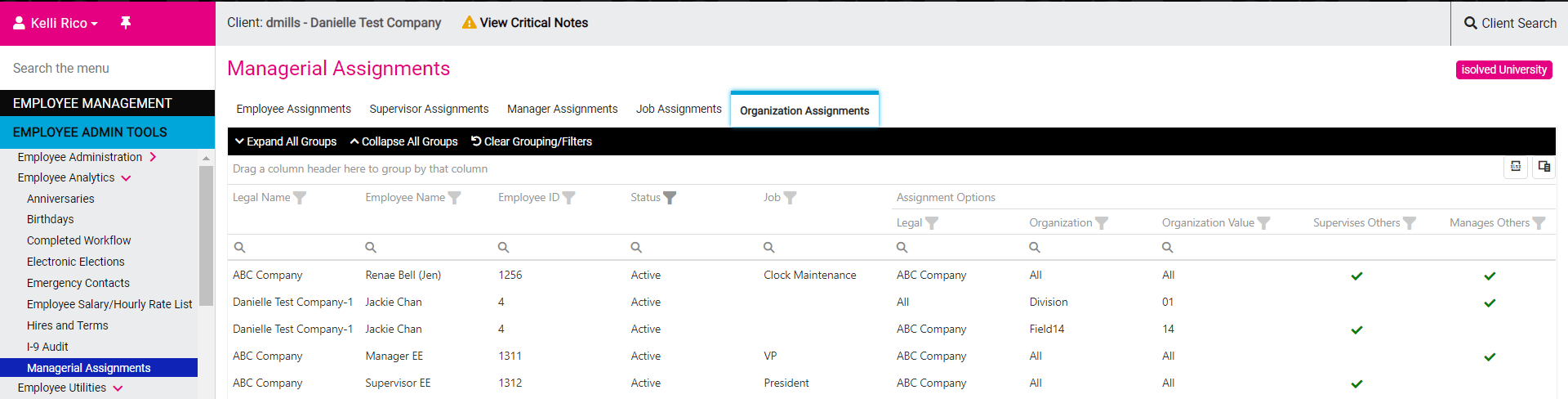

Managerial Assignments

In our last 7.14 release we added a Managerial Assignments analytics screen for Employees, Supervisors, Managers, and Job assignments. With our 7.15 Release we have added a new tab titled “Organizational Assignments” located to the right of Job Assignments at the top navigation bar. This tab will display active and inactive employees who are categorized as managers and supervisors within your managers. Like the Employee Assignments and Job Assignments Tabs, users can export reports to Microsoft Excel or use the filters within Column Chooser to reflect their specific viewing preferences. The data seen in the Managerial Assignments screen is obtained from the Organization Supervisor/Manager screen under Employee Maintenance.

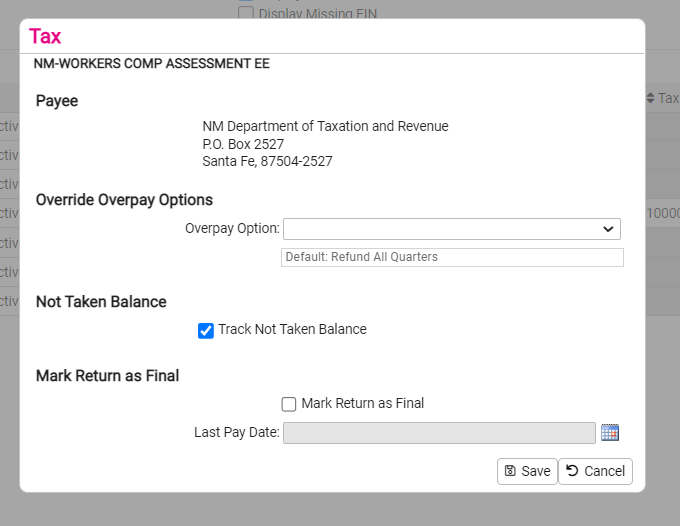

Payroll & Tax Maintenance

When adding a company located within New Mexico, users will now be prompted with a popup window that has the check box “Track Not Taken Balance” option automatically defaulted on the New Mexico Workers Compensation Assessment Employee Tax Fee. This release was catalyzed by New Mexico’s reconciliation challenge that occurs when the employee is not being paid. If the employee is not listed there or doesn’t pay their fee at the end of the quarter, the fee will revert to the employer who is responsible for any unpaid tax.

Got questions? Contact our team!