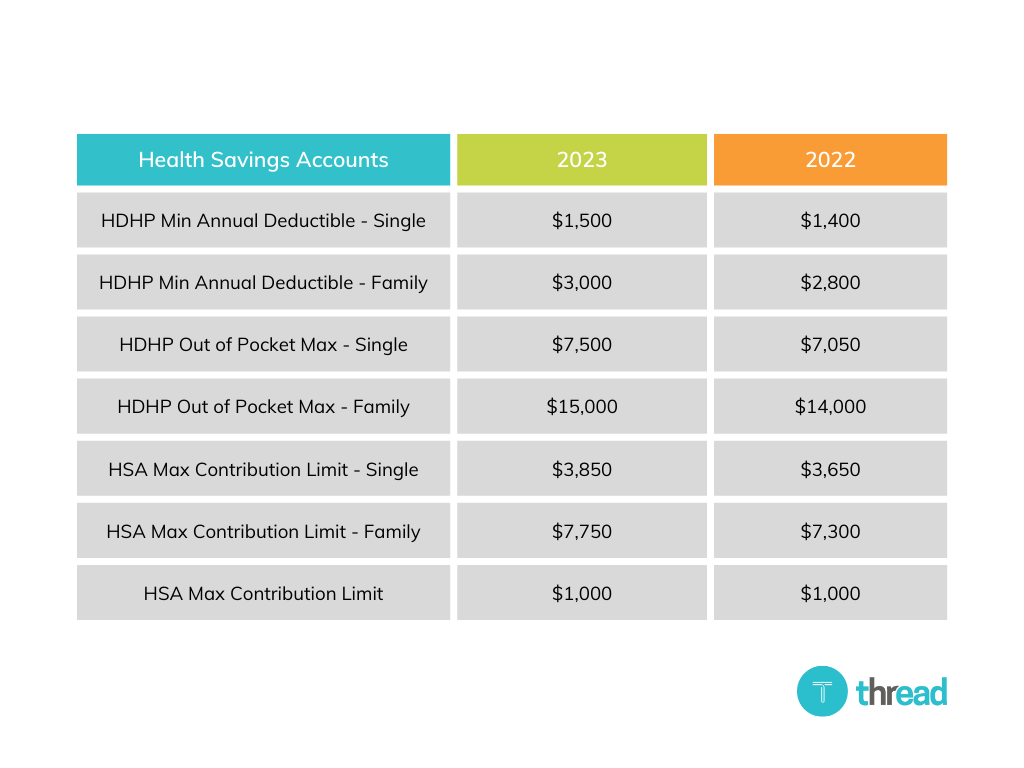

The IRS announced HSA contribution limits effective for the calendar year 2023 with Revenue Procedure 2022-24, along with minimum deductible and maximum out-of-pocket expenses for the HDHPs.

If you have any questions, please reach out to your HCM Consultant directly or by contacting us at 678-578-5082.

If you have any questions, please reach out to your HCM Consultant directly or by contacting us at 678-578-5082.